Insurance Fraud Investigation: Essential Guide for Claim Experts

- Showix technical Team

- Jun 21, 2025

- 13 min read

Updated: Jul 28, 2025

Understanding Insurance Fraud Investigation: More Than Just Claim Checking

An insurance fraud investigation goes far beyond a simple administrative review of a claim form. Think of it less like a box-ticking exercise and more like financial detective work. The main goal is to methodically examine suspicious insurance claims to figure out if they are legitimate. This isn’t about denying valid claims; it’s about protecting the insurance system from deliberate deception that costs everyone money. At its core, the process involves separating genuine misfortune from calculated fraud.

This field has evolved past just verifying paperwork. Today’s investigators blend traditional detective skills with sharp analytical thinking. They must think like a forensic accountant, tracing financial inconsistencies, while also acting like a behavioural analyst, interpreting human actions and motives. It requires a specific mindset—one that can spot the subtle inconsistencies in a story or the single piece of data that doesn’t quite fit. This dual approach is vital for uncovering schemes designed to look completely legitimate on the surface.

The Modern Investigator's Role

The role of a modern fraud investigator is multifaceted. They don't just react to red flags; they actively look for them using a combination of data analysis and human intuition. Their responsibilities often include:

Evidence Gathering: This involves collecting documents, digital records, witness statements, and physical evidence connected to a claim.

Interviews: Conducting structured conversations with claimants, witnesses, and others involved to clarify details and assess credibility.

Surveillance: When necessary and legally permissible, observing a claimant’s activities to verify the extent of their claimed injuries or losses.

Data Analysis: Examining large datasets to identify patterns, connections, and irregularities that suggest fraudulent activity.

The Scale of the Problem

The need for thorough insurance fraud investigation isn't just a theoretical concept; it's a direct response to a major and growing financial threat. The size of this issue is immense. For example, Allianz UK, a leading insurer, reported detecting a record £157 million in fraud in 2024 alone, a 10% increase from the previous year. This figure represents 33,027 separate fraudulent claims, highlighting the sheer volume of deceptive acts that professionals must tackle. You can read about the findings of this fraud report on Allianz.co.uk.

This isn't just a problem for large corporations; these costs are ultimately passed on to honest policyholders through higher premiums. For businesses dealing with internal fraud, understanding the methods used by corporate investigators is key to building a strong security playbook. This highlights the crucial function of dedicated insurance fraud investigation in protecting the entire system.

Fraud Schemes That Keep Investigators Busy: Real-World Patterns Revealed

Fraudsters can be remarkably creative, putting together schemes that range from the obviously false to the incredibly detailed. For an insurance fraud investigation to be effective, it isn't enough to just react to claims as they come in. It requires a deep understanding of the common patterns fraudsters use. These schemes are rarely random; they usually follow predictable scripts that a skilled investigator learns to recognise. Think of it like a veteran theatre critic watching a play—they can spot a weak plot or a fumbled line long before the final act.

Many fraudsters begin with simple opportunism. A genuine, minor car accident might be blown out of proportion with claims of severe whiplash, or a small water leak at home becomes a claim for a complete room renovation. This is known as claims inflation or padding, and it’s one of the most frequent types of fraud. While each case might seem small, the combined effect of thousands of padded claims adds up to significant losses for the industry. The real test for an insurance fraud investigation is to tell the difference between genuine hardship and a convincing performance.

Common Fraud Scenarios

Moving beyond simple exaggerations, investigators often find themselves dealing with more organised and deliberate schemes. These typically fall into several main categories, each with its own revealing signs. To better understand these, let's look at the common schemes, what to watch for, and how investigators tackle them.

Fraud Type | Common Indicators | Investigation Approach | Detection Rate |

|---|---|---|---|

Staged Accidents | Multiple occupants in the fraudster's car, pre-existing vehicle damage, conflicting witness statements, immediate claims for soft tissue injuries. | Scene analysis, vehicle examination, background checks on all parties, surveillance to verify injury claims. | High, with experienced investigators. |

Phantom Injuries | Vague, subjective symptoms (e.g., chronic pain), resistance to independent medical exams, frequent doctor changes. | Medical record analysis, independent medical examinations (IMEs), covert surveillance to document physical activity. | Moderate to High, depends on surveillance success. |

Fabricated Incidents | Lack of independent witnesses, forged documents (receipts, police reports), immediate claim after policy inception. | Document verification, checking for prior similar claims, interviews with alleged witnesses, site visits. | Moderate, relies on spotting forged evidence. |

Organised Fraud Rings | Multiple claims involving the same individuals, vehicles, or medical providers; claims filed with several insurers at once. | Data analysis to find connections, multi-agency collaboration, in-depth financial investigation. | Varies, can be difficult but high-impact. |

These examples show that while the schemes vary, the investigative approach must be just as adaptable, combining old-school detective work with modern data analysis.

The Rise of Identity-Related Fraud

A growing worry for any insurance fraud investigation is the use of stolen or synthetic identities. Criminals are increasingly using personal data, often bought from the dark web, to impersonate legitimate policyholders and file entirely fake claims. This digital-first method adds a new layer of difficulty for investigators.

Recent data shows just how serious this trend is. In 2024, identity fraud was a major driver of insurance-related fraud in the UK, making up 59% of all reported cases. The motor insurance sector was particularly affected, experiencing an 8% increase in fraud cases connected to identity theft.

Investigation Tools That Actually Work: Technology Meets Street Smarts

A successful modern insurance fraud investigation is a careful blend of digital analysis and traditional detective work. Forget the Hollywood image of investigators relying solely on hunches; today’s reality is about combining high-tech analytics with essential, on-the-ground intelligence gathering. Think of it less as a single "gotcha" moment and more like building a solid case piece by piece, using every tool available. This fusion of technology and classic skills makes the process of checking suspicious claims more thorough and effective.

Technology often provides the first breadcrumb. Artificial Intelligence (AI) systems can analyse thousands of claims far quicker than any human team, flagging patterns that suggest something isn't right. These systems can cross-reference details across multiple databases, instantly spotting if the same "accident" has been reported to different insurers or if a claimant has a history of questionable claims. This initial digital filter helps investigators focus their energy on cases that genuinely need a closer look.

Combining Digital Evidence with Human Insight

Once a claim is flagged, the investigation becomes more hands-on, where digital clues meet real-world verification.

Social Media and Online Presence: Investigators often use open-source intelligence (OSINT) to check a claimant’s online activity. A person claiming a debilitating back injury might accidentally post photos of themselves completing a marathon, directly contradicting their claim.

Digital Forensics: The metadata from a smartphone photo can be invaluable. For instance, GPS data embedded in an image can prove a vehicle was nowhere near the supposed accident scene at the time of the incident.

Database Cross-Referencing: Beyond AI, manual checks of public records, vehicle registrations, and other databases can uncover networks of individuals involved in organised fraud rings.

Here is an example of the types of specialised fields, like forensic accounting, that are increasingly integrated into complex fraud cases.

This screenshot shows that forensic accounting is used in legal proceedings, a vital component for building watertight insurance fraud cases.

The Irreplaceable Value of 'Street Smarts'

Despite technological progress, traditional techniques remain at the heart of any insurance fraud investigation. Technology can point you in the right direction, but it can’t conduct a witness interview or observe a subject’s daily activities.

This is where the "street smarts" of an experienced investigator become so important. Fieldwork, such as discreet surveillance, is often the only way to confirm or deny the legitimacy of a physical injury claim. A comprehensive private investigator surveillance guide can offer insights into the legal and practical aspects of these operations.

Furthermore, witness interviews are crucial for understanding the context of an event and judging the credibility of those involved. In the complex world of investigations, using every technological advantage is key. Beyond specialised forensic tools, general-purpose software can also play a part. For example, tools for enhancing productivity, such as speech-to-text software, can greatly simplify an investigator's daily workflow by speeding up report writing. Ultimately, the strongest cases are built when digital evidence is backed by tangible, real-world proof gathered through skilled investigative work.

From First Red Flag to Final Decision: How Investigations Really Work

Every insurance fraud investigation follows a deliberate path, starting from a gut feeling that something isn’t right and ending with a final, evidence-backed decision. This journey isn't a mad dash; it’s a structured process designed to be thorough while respecting the practical limits of time and money. The first step, triage, is one of the most important. Investigators must carefully sort their caseload, figuring out which claims need a deep-dive investigation and which can be cleared up with a few simple checks.

Think of this initial stage like a hospital's A&E department. An investigator assesses each incoming claim for classic signs of a serious problem—the red flags we discussed earlier. A claim with several obvious red flags is prioritised for immediate action, just like a critical patient. One with a minor inconsistency might be monitored for a while longer. This system ensures that the most skilled resources are focused on the cases with the highest fraud potential, making the investigation team's efforts more effective.

The Investigative Pathway

Once a case is selected for a closer look, the investigation moves through several key stages. The exact details can change depending on the type of claim, but the overall flow provides a reliable framework for gathering and evaluating information without bias.

Initial Review and Planning: The investigator takes a close look at the claim file and creates an investigation plan. This plan maps out what needs to be confirmed, who to interview, and what specific evidence is needed.

Evidence Gathering: This is the heart of the insurance fraud investigation. It involves collecting all necessary documents, speaking with claimants and witnesses, and, when legally appropriate, carrying out surveillance to check the facts.

Analysis and Reporting: All the evidence is pieced together to form a complete picture. The investigator writes a detailed report, laying out the evidence both for and against the claim's validity.

Final Decision: With the comprehensive report in hand, the insurer makes its final call. This could mean approving the claim, denying it, or, in more serious instances, passing the case to the police.

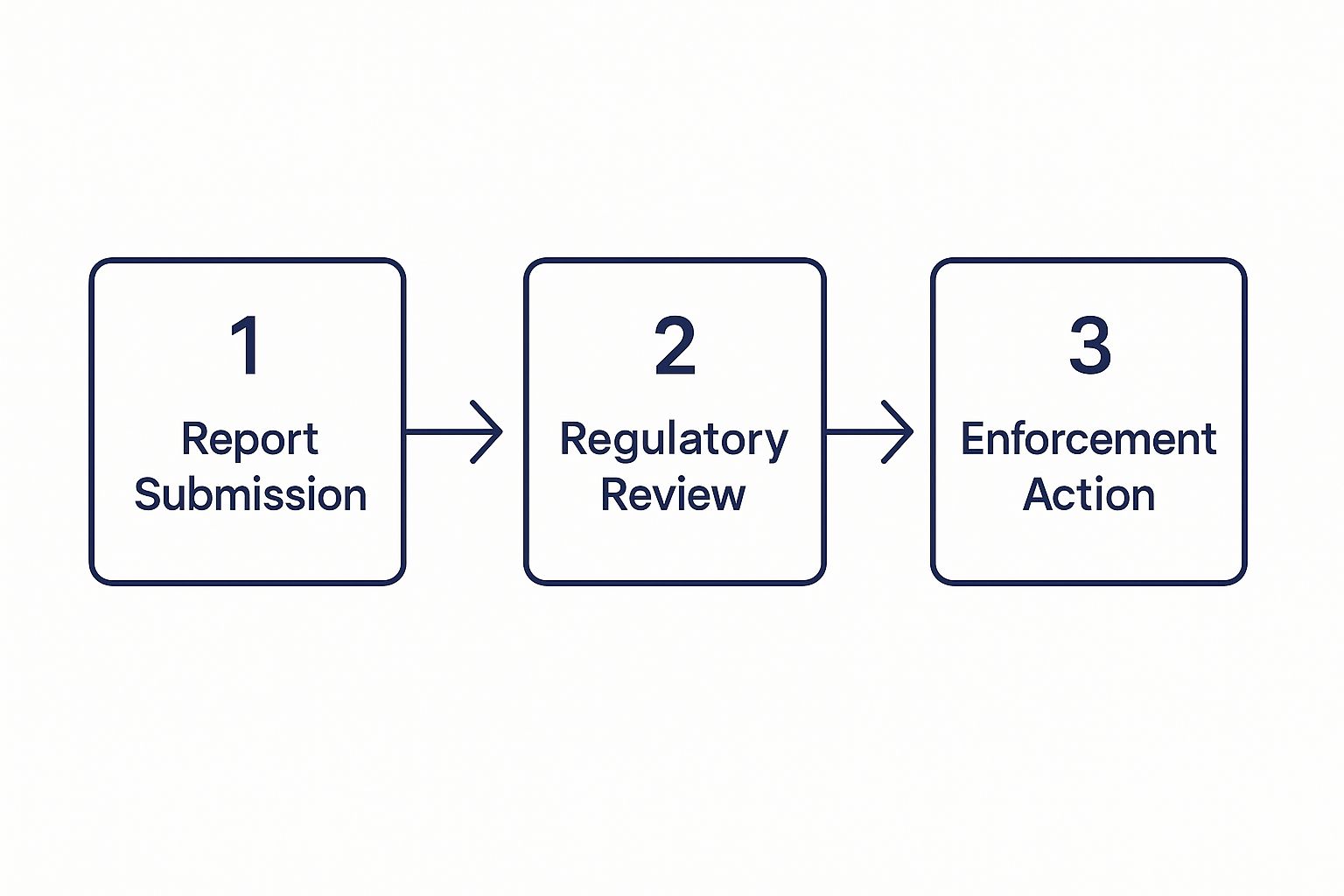

The infographic shows that every report triggers a review. This review is the critical point where the depth of the investigation is decided before any final action is taken.

Maintaining Objectivity and Fairness

It's vital to remain objective throughout this process. The aim isn't to prove fraud at all costs but to uncover the truth, whatever that may be. An investigator must follow the evidence, even if it points away from their initial suspicions. Data from the Association of British Insurers (ABI) shows that while many claims are checked for fraud, the vast majority are genuine. Most of these checks are handled by insurers' own counter-fraud teams, who are trained to conduct fair and balanced enquiries. You can discover more insights about this data on the ABI website. This dedication to fairness helps ensure honest customers aren’t penalised, while fraudulent claims are identified and stopped.

Staying Legal While Getting Results: Navigating the Compliance Maze

A successful insurance fraud investigation is more than just uncovering deception; its findings must stand up in court and respect privacy laws. This creates a difficult balancing act for investigators. Imagine walking a tightrope: on one side, you have the goal of gathering evidence, and on the other, you have the claimant's legal right to privacy. One wrong move can jeopardise the entire case, leading to legal trouble for the insurer.

The legal landscape is particularly tricky, especially in the UK with the General Data Protection Regulation (GDPR). This law sets firm rules for how personal data is collected, handled, and stored. For investigators, this means every action, from taking a surveillance photo to capturing a social media post, must have a solid legal basis. Ignoring these rules can get evidence dismissed and lead to heavy fines. The line between thorough investigation and illegal intrusion is thin but crucial.

The Burden of Proof and Evidence Standards

A vital part of any lawful investigation is understanding the burden of proof. In civil fraud cases, the standard is usually "on the balance of probabilities." This means you have to show it's more likely than not that fraud took place. However, if the investigation points towards more serious, criminal activity, this standard changes.

Should a case move from a civil claim to a criminal one that involves the police, the standard becomes much higher: "beyond a reasonable doubt." This requires airtight, undeniable evidence. The courts have very specific rules about what evidence is allowed.

To better understand these requirements, the table below outlines the legal standards and compliance obligations for different types of evidence commonly used in insurance fraud cases.

Legal Standards for Insurance Fraud Evidence

Overview of evidence requirements, legal thresholds, and compliance obligations for different types of fraud cases

Evidence Type | Legal Standard | Compliance Requirement | Admissibility Factors |

|---|---|---|---|

Surveillance Footage | Must be gathered in a public space, respecting the individual's reasonable expectation of privacy. | Adherence to GDPR and the Regulation of Investigatory Powers Act 2000 (RIPA) is mandatory. | Clear, continuous footage is needed. Audio recording is generally prohibited. The surveillance must be proportionate to the case. |

Digital Evidence | A clear chain of custody must prove the evidence has not been tampered with. | Data processing must be lawful and for a specific, legitimate purpose as defined by GDPR. | Must be authentic, relevant, and legally obtained. Proof of lawful access and preservation is key. |

Witness Statements | Must be given voluntarily and recorded accurately, without any form of pressure or leading questions. | The interviewee must be informed about why their data is being collected and its intended use. | The witness's credibility and the consistency of their statement with other evidence are critical. |

Financial Records | Can only be accessed with proper legal authority (like a court order) or the individual's explicit, informed consent. | Strict compliance with financial privacy laws and data protection principles is essential. | Must be directly relevant to the claim and obtained through lawful channels. |

Successfully navigating this complex legal environment is fundamental to a good investigation. It often involves professional support, such as robust cybersecurity and compliance services, to ensure every step is lawful. History is full of cases where insurers had to pay large settlements because an investigator crossed a legal line.

The main takeaway is that lawful evidence gathering isn't just a suggestion—it's the bedrock of a strong case. It protects the organisation from legal risk while ensuring that fraudulent activity is properly and effectively challenged.

When To Call In The Specialists: Making Smart Investigation Investments

While your in-house team is great for managing routine checks, some situations require a deeper level of specialised knowledge. Knowing when to pass a case to external specialists is a crucial decision. Think of your internal team like a skilled GP; they handle most health concerns but know exactly when to refer a patient to a heart surgeon for a complex operation. Investing wisely in professional services can be the difference between paying a costly fraudulent claim and successfully challenging it.

Not every suspicious claim needs the expense of a full-scale external insurance fraud investigation. However, certain red flags should make you think about bringing in experts. The key is to see when a case's difficulty or the resources needed are beyond what your internal team can handle. This strategic choice helps you put your budget where it will have the most impact.

Scenarios That Warrant Specialist Intervention

Certain types of cases almost always benefit from the help of a professional investigation firm. These specialists have the tools, experience, and focused attention that can be hard for an internal team to provide, especially when dealing with a large caseload. You should think about calling for support in these situations:

Complex or High-Value Claims: When a claim could lead to a large payout, the cost of a professional investigation is easily justified. Experts can spend the time needed to make sure every detail is checked.

Need for Specialised Skills: Cases that require deep technical knowledge, such as digital forensics to analyse doctored evidence or medical experts to dispute complicated injury claims, are ideal for outsourcing.

Suspected Organised Crime: If you think a claim is part of a bigger fraud ring with multiple people involved, possibly across different regions, you need a dedicated firm with experience in large-scale operations.

Requirement for Fieldwork: When a case needs evidence to be gathered on the ground, like covert surveillance to check a claimant's physical abilities, professional investigators are equipped to do this legally and effectively. To learn more about the skills involved, our insurance fraud investigator career guide provides more detailed information.

Evaluating and Engaging a Professional Firm

Picking the right investigation partner is essential. Go beyond their marketing and look at their actual track record. Ask for case studies that are relevant to your situation and check their credentials. A trustworthy firm will be open about their methods, what they can do, and how long they expect things to take.

When you hire them, be clear about the goals and what you expect to receive from the start. This makes sure everyone agrees on what a successful outcome looks like. Good communication between your internal team and the external investigators is also vital. Set up clear ways to share information and manage the case for a smooth process. This teamwork approach ensures you get the most value from your investment and leads to solid, evidence-based results.

Building Fraud Prevention Systems That Work: Beyond Detection to Prevention

The best way to handle an insurance fraud investigation is to stop the fraud before it ever happens. While having strong detection and investigation processes is crucial for catching fraudulent activity, a proactive prevention strategy is your first and most powerful line of defence. Think of it this way: an investigation team is like a skilled fire brigade, brilliant at putting out fires once they start. A prevention system, however, is like installing smoke detectors and fire-retardant materials throughout a building—it stops most fires before they cause real damage. The goal is to create systems that put off dishonest claimants while ensuring legitimate customers have a straightforward, positive experience.

Leading insurers are embedding intelligent filters into the very first stages of the claims process. This forward-thinking approach not only saves money but also protects the integrity of the insurance pool for all policyholders.

Proactive Measures in Modern Insurance

A solid prevention framework rests on two key pillars: smart technology and a well-informed human workforce. One can't work effectively without the other.

Risk Scoring Models: When a claim is first submitted, advanced algorithms can instantly assess its risk profile. These models analyse hundreds of data points, from the type of loss to the claimant's history, to assign a risk score. A high score doesn't automatically mean fraud, but it does flag the claim for a closer look by a human reviewer before any payment is made. This nips potentially fraudulent claims in the bud.

Effective Staff Training: Technology is only one piece of the puzzle. It's vital to build a culture of fraud awareness across the entire organisation. Proper training teaches employees, from underwriters to claims handlers, how to recognise the subtle red flags of fraud without becoming overly suspicious of every customer. This creates an environment where staff are vigilant but not paranoid, improving both security and customer service.

The Value of Collaboration

No insurer operates in a bubble. Fraudsters often target multiple companies at once, which makes industry-wide cooperation a powerful tool for prevention. By taking part in data-sharing initiatives and collaborative networks, insurers can spot organised fraud rings much faster than they could on their own. When one company flags a suspicious individual or vehicle, that information can be securely and legally shared with others, strengthening the entire sector's defences. These partnerships, combined with keeping up with new regulations, are shaping the future of fraud prevention.

Ultimately, investing in these prevention systems delivers clear returns. It cuts down on direct financial losses from fraud, simplifies the claims process for honest customers, and frees up investigative resources to focus on the most complex and serious cases.

Facing a complex claim that needs a specialist's eye? Contact Sentry Private Investigators Ltd for discreet, professional support. Visit our website at https://www.sentryprivateinvestigators.co.uk to see how our expert services can protect your business.