Insurance Fraud Investigator: Career Guide & Expert Tips

- Sentry Private Investigators

- Jun 5, 2025

- 12 min read

Updated: Jul 28, 2025

What Insurance Fraud Investigators Actually Do Daily

Insurance fraud investigators are essential for protecting the insurance industry and the public. Their daily work is varied and demanding, requiring analytical skills, attention to detail, and a commitment to finding the truth. A typical day might involve reviewing claim documents for inconsistencies or interviewing claimants and witnesses to gather information and evaluate their credibility.

Core Responsibilities and Investigative Techniques

An investigator might, for instance, review medical records in a personal injury claim, looking for discrepancies between the reported injuries and the medical documentation. They might also conduct surveillance to verify a claimant’s activities and limitations, potentially uncovering evidence of exaggeration or fabrication. This can range from simple observation to using advanced surveillance technology. Check out our guide on private investigator surveillance.

Analysing financial records is another important aspect of their work. This might involve tracing transactions, identifying suspicious patterns, or uncovering hidden assets. Therefore, insurance fraud investigators often need a solid understanding of accounting principles and financial investigation techniques. They might also work with other professionals, such as forensic accountants or digital forensic experts, to build a strong case.

Furthermore, insurance fraud investigators work alongside law enforcement and legal teams. They prepare detailed reports and present evidence in court, which can lead to successful prosecutions and the recovery of stolen funds. Their work is key to deterring fraud and maintaining the integrity of the insurance system.

Types of Fraud Investigated

Insurance fraud comes in many forms, and investigators must be skilled at recognising and handling a variety of schemes. These can include fraudulent personal injury claims investigations, staged accidents, exaggerated property damage claims, and organised fraud rings. An investigator might, for example, uncover a staged car accident where people intentionally crash their vehicles to file false claims. Or they might encounter cases of arson, where individuals deliberately set fire to their property to collect insurance payouts. The increasing use of online platforms and digital transactions has also resulted in a rise in cyber-enabled insurance fraud.

Collaboration and Data Analysis in UK Fraud Investigations

Using data and collaborative efforts is essential to tackling insurance fraud in the UK. For example, the Insurance Fraud Bureau (IFB) works with its member organisations to investigate and prevent fraud. In one case, the IFB identified 23 fraudulent insurance policies linked to a scam network impacting eight major insurers. Discover more insights about combating insurance fraud. This case involved linking suspects to compromised identities and policies used in vehicle theft. Such collaborative work demonstrates the importance of industry-wide cooperation to combat complex fraud schemes and ensure resources are used effectively. You might be interested in: Personal Injury Fraud Investigation.

Breaking Into Insurance Fraud Investigation Careers

Entering the field of insurance fraud investigation can be a rewarding career path. It offers a dynamic work environment and the satisfaction of knowing you're contributing to a fairer insurance system. There are several ways to break into this field, depending on your background and skills.

Diverse Entry Routes and Essential Qualifications

Many investigators transition from law enforcement, bringing valuable transferable skills. Experience in investigations, interviewing, and evidence gathering is highly sought after. Working within the insurance industry, particularly as a claims adjuster, can also be excellent preparation. Adjusters gain a deep understanding of policy procedures and common fraud indicators. You might also be interested in: How to become a private investigator in the U.K.

Even without direct experience, your existing skills can be a stepping stone. Strong analytical skills, attention to detail, and excellent communication are all vital. For instance, a financial background could be helpful in analysing financial records and spotting suspicious transactions.

Formal qualifications can enhance your prospects. A degree in criminology, law, or a related field is beneficial. Professional certifications, like those from the Chartered Insurance Institute, are highly valued. Specialised fraud investigation training programs can further refine your skills and demonstrate commitment to the profession.

Essential Skills and Building a Compelling CV

Beyond formal qualifications, certain core skills are essential. Analytical thinking is crucial for sifting through large volumes of information and identifying patterns. This requires meticulous attention to detail to uncover hidden clues.

Excellent communication skills, both written and verbal, are also key. Investigators must convey their findings clearly and persuasively in reports, presentations, and potentially court testimonies. Honing advanced interviewing techniques is vital for gathering information from various sources.

When creating your CV, highlight your relevant skills and experience concisely. Quantify your achievements whenever possible. For example, instead of saying you "investigated claims," specify the number of claims handled and the value of fraud detected.

Gaining Experience and Networking for Success

Practical experience is invaluable. Internships with insurance companies or investigative firms offer hands-on training. Strategic volunteering, such as with citizen’s advice bureaus or fraud awareness campaigns, can demonstrate commitment and expand your network.

Networking within the industry is crucial. Attending industry events, joining professional organisations like the Association of Certified Fraud Examiners (ACFE), and connecting with experienced investigators provides valuable insights and potential job opportunities. Learning from established professionals is an excellent way to gain practical advice. For businesses requiring specialised investigation services, consider Fraudulent personal injury claims investigations.

Insurance Fraud Investigator Salaries and Growth

Insurance fraud investigation is a burgeoning field in the UK, offering competitive salaries and diverse career options. Understanding potential earnings and growth opportunities can help you decide if this is the right career for you.

Salary Expectations Across the UK

Salaries for insurance fraud investigators differ based on experience, location, and specialisation. Entry-level positions in regional UK areas typically start between £25,000 and £30,000 annually.

With experience, mid-level investigators can earn between £35,000 and £45,000. Senior investigators, especially those in London and the Southeast, can command salaries from £50,000 to £70,000 or more.

Specialising in high-value commercial fraud or leading a team can boost earning potential even further. Many positions also include benefits such as private healthcare, company cars, and performance bonuses.

To help you visualise potential earnings based on experience and location, take a look at the table below:

UK Insurance Fraud Investigator Salary Ranges by Experience Level

Experience Level | London/Southeast | Regional UK | Additional Benefits |

|---|---|---|---|

Entry-Level | £25,000 - £30,000 | £25,000 - £30,000 | Performance Bonus, Private Healthcare (Variable) |

Mid-Level | £35,000 - £45,000 | £30,000 - £40,000 | Company Car, Performance Bonus, Private Healthcare (Variable) |

Senior-Level | £50,000 - £70,000+ | £40,000 - £60,000+ | Company Car, Enhanced Pension, Performance Bonus, Private Healthcare |

This table provides a general overview and actual salaries may vary. Benefits packages can also differ significantly between companies.

Career Progression and Development

Starting as a junior investigator provides a strong base for advancement. As you gain experience, you can move into senior positions, managing teams, handling complex cases, or focusing on specific fraud types, such as fraudulent personal injury claims.

The industry supports continuing professional development through organisations like the Chartered Insurance Institute CII, helping you build valuable skills. Much like transitioning from a military career, entering the insurance fraud investigation field requires planning. This guide on Transitioning From Military to Civilian Jobs offers useful advice.

The Impact of Technology on Growth

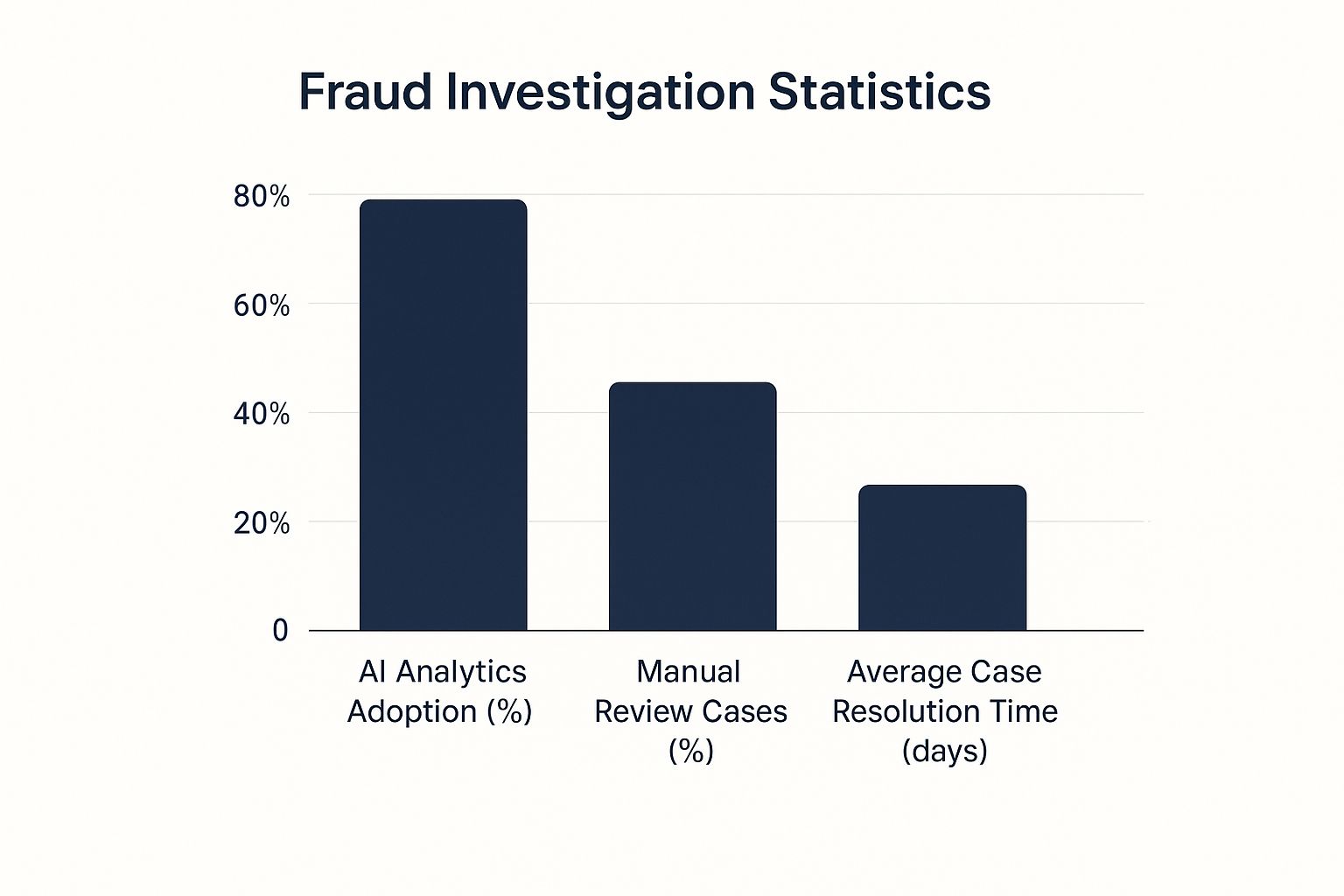

The rising use of AI and data analytics in fraud detection is creating specialised roles. This fuels the demand for investigators skilled in data analysis, digital forensics, and cyber security. The following infographic shows how AI is changing fraud investigations:

As AI adoption increases, manual reviews decrease, leading to quicker resolution times. This indicates that technology is not replacing investigators; it's reshaping their roles. This creates openings for up-skilling and specialising, further improving career prospects within this dynamic field.

For those needing help with personal injury claim investigations, resources like Fraudulent personal injury claims investigations can provide expert support. The growing focus on fraud prevention and ongoing technological advancements ensure that insurance fraud investigation remains a promising career path.

The Real Impact Of Professional Fraud Investigation

Insurance fraud investigators have a significant impact, affecting not only insurance companies but the entire UK economy. These professionals are essential for maintaining financial stability and protecting honest policyholders. Their work ensures that the costs of fraud aren't passed on through higher premiums.

Financial Savings For Insurers and Consumers

Effective fraud detection leads to substantial financial savings for insurance companies. This helps keep premiums affordable. Imagine fraudulent claims going unchecked. The resulting payouts would lead to higher premiums for all policyholders, even those with legitimate claims.

Insurance fraud investigators prevent this by identifying and stopping fraudulent claims. This saves the company money and protects honest policyholders from unfair premium increases. These savings can then be used to improve services and develop better products.

Combating Evolving Fraud Schemes

Insurance fraud is constantly changing, with criminals using increasingly complex methods. From elaborate personal injury scams to complicated cyber-enabled schemes, fraudsters are always seeking new ways to exploit the system. Insurance fraud investigators must constantly adapt their techniques to stay ahead of these threats.

They achieve this by adopting new technologies, developing advanced analytical skills, and working with law enforcement and legal professionals. This ongoing adaptation ensures they can handle even the most complex fraud schemes.

Maintaining Trust And Stability In The Industry

Insurance fraud investigators are crucial for protecting the integrity of the insurance system. By detecting and preventing fraud, they maintain public trust in the industry. This trust is essential for the stability of the insurance market and the broader financial system. Read also: Personal Injury Fraud Investigation.

Their work also protects consumers from hidden costs. Without effective fraud detection, the financial burden of fraudulent claims would fall on honest policyholders. Insurance fraud investigators work to prevent this from happening.

Furthermore, UK insurance fraud investigators have become increasingly effective. In 2024, Allianz UK detected a record £157 million in fraud, a 10% increase from the previous year. This represents 33,027 instances of detected fraud. This highlights the effectiveness of advanced investigative techniques and insurer collaboration in the UK. For those dealing with personal injury claims, Fraudulent personal injury claims investigations offer specialised expertise.

Choosing The Right Investigation Services Partner

Selecting the right insurance fraud investigator is a critical decision for businesses and individuals alike. The effectiveness of an investigation can significantly impact financial outcomes and legal proceedings. Understanding what to look for in a quality investigative partner is essential for a successful resolution.

Key Factors to Consider When Selecting a Partner

When choosing an insurance fraud investigator, several key factors should guide your decision. These factors can help ensure you select a partner who is best suited to your specific needs and circumstances.

Proven Track Record: Look for demonstrable success in uncovering fraudulent activities. Examining case studies and testimonials can offer valuable insights into an investigator's effectiveness and experience.

Specialisations: Different investigators possess expertise in various areas. Some specialise in surveillance, while others focus on financial analysis or digital forensics. Choosing a specialist whose skills align with your case is crucial.

Approach to Evidence Gathering: A reliable investigator must adhere to ethical and legally sound practices. This is paramount to ensuring the admissibility of evidence in court.

Comprehensive Report Preparation: A well-structured and detailed report is vital for presenting a strong case. Seek investigators who can provide clear, concise, and legally sound documentation.

To help illustrate the different types of investigation services available, we've compiled the following table:

Types of Insurance Fraud Investigation Services

This table compares different investigation services available to businesses and individuals, highlighting their typical applications and expected outcomes.

Service Type | Best Used For | Typical Timeline | Evidence Provided |

|---|---|---|---|

Surveillance Specialists | Suspected staged accidents, exaggerated injuries | Varies depending on the complexity of the case; can range from a few days to several weeks | Video footage, photographs, detailed activity logs |

Forensic Accountants | Suspected financial fraud, hidden assets, misrepresentation of financial records | Several weeks to several months depending on the volume of financial data | Financial reports, analysis of transactions, identification of discrepancies |

Digital Investigation Experts | Online fraud, data breaches, recovery of deleted data | A few weeks to several months, depending on the complexity of the digital systems involved | Recovered data, analysis of online activity, expert testimony on digital evidence |

This table provides a general overview. Specific timelines and evidence provided will vary based on individual case details.

Matching Expertise to Your Specific Needs

Various types of investigative services cater to a range of needs. Choosing the right type depends on the specifics of the situation.

Surveillance Specialists: These professionals are adept at covert surveillance. They gather evidence of potentially fraudulent activities through discreet observation and documentation.

Forensic Accountants: These experts specialise in analysing financial records to detect discrepancies, hidden assets, and other indicators of financial fraud. Their skills are invaluable when financial irregularities are suspected.

Digital Investigation Experts: In our increasingly digital world, much of the evidence related to insurance fraud resides online. Digital investigators are skilled in recovering and analysing electronic data, providing critical insights into online activities.

For instance, if a personal injury claim involves suspected exaggeration of injuries, surveillance might be the best investigative route. If financial fraud is suspected, a forensic accountant would likely be more appropriate. Complex cases may necessitate a team with diverse expertise.

Evaluating Credentials and Asking the Right Questions

Thoroughly vetting potential investigative partners is crucial. This includes verifying licenses, certifications, and professional affiliations. Asking direct questions about their experience, methodologies, and approach to specific case types is equally important. Understanding estimated timelines, costs, and deliverables upfront can help you manage expectations and budget accordingly.

For individuals facing potentially fraudulent personal injury claims, consider professional services that specialise in these types of investigations. Companies like Fraudulent personal injury claims investigations offer targeted expertise. Choosing the right partner can help efficiently uncover deceitful activities, strengthening your legal standing.

Selecting the right insurance fraud investigator ensures the investigation is conducted professionally and ethically. By carefully considering these factors, you can select a partner who will deliver the results you need. This protects you, your business, and the integrity of the insurance system.

Cutting-Edge Technology Transforming Investigations

Technology is rapidly changing how insurance fraud investigators in the UK operate, giving them new tools to detect and prevent fraud. These advancements are increasing the efficiency and accuracy of investigations, leading to better outcomes for both insurers and policyholders.

Data Analytics and AI-Powered Systems

Data analytics plays a crucial role in modern insurance fraud investigations. Investigators use sophisticated software like Tableau to analyse large datasets, identifying patterns and anomalies that might indicate fraudulent activity. For example, these systems can flag claims that deviate significantly from the norm, prompting further investigation.

AI-powered pattern recognition systems are also becoming increasingly important. These systems can learn to identify complex fraud patterns that might be missed by human analysts. This allows investigators to focus their efforts on the most suspicious claims, making the investigation process more efficient.

Advanced Surveillance and Social Media Intelligence

Surveillance technology has also come a long way. High-definition cameras, GPS tracking, and other tools provide investigators with more detailed and accurate information than ever before. This helps to build stronger cases against those suspected of fraud.

Social media intelligence gathering has become an invaluable tool. Investigators can use social media platforms to gather evidence of fraudulent activity, such as inconsistencies between a claimant’s reported injuries and their online activity.

Digital Forensics and Open-Source Intelligence

The rise of cyber-enabled fraud has led to the increased use of digital forensics in insurance fraud investigations. Investigators can now recover deleted data, analyse online transactions, and track online activity to uncover evidence of fraud. This is particularly important for investigating complex fraud schemes that involve multiple parties or jurisdictions.

Open-source intelligence (OSINT) has also become a valuable resource. Investigators can use publicly available information, such as company registers, news articles, and social media profiles, to gather intelligence and build a more complete picture of a case. While technology is reshaping investigations, it’s important to remember the wider context of fraud within the UK. The Department for Work and Pensions (DWP) publishes data on benefit system fraud, offering insights into prevention strategies. Find more detailed statistics here.

Legal Compliance and the Future of Investigations

It is crucial that insurance fraud investigators use these powerful technologies ethically and legally. Evidence must be gathered and handled in a way that complies with data protection laws and other relevant regulations. Ensuring compliance protects the integrity of the investigation and its findings.

The continued advancement of technology promises even more powerful tools for insurance fraud investigators. This ongoing evolution requires investigators to stay up-to-date with the latest techniques and maintain the highest standards of evidence gathering. For businesses and individuals seeking assistance with personal injury claim investigations, specialised services like Fraudulent personal injury claims investigations can provide the expertise needed to navigate this complex landscape.

What's Next For Insurance Fraud Investigation

The insurance fraud investigation landscape is constantly shifting, adapting to new technologies and evolving fraudster tactics. This requires investigators to continuously learn and refine their skillset to stay ahead. As digital evidence becomes increasingly critical in these investigations, understanding secure document sharing best practices is paramount.

The Rise of AI and Machine Learning

Artificial intelligence (AI) and machine learning are revolutionising fraud detection and prevention. These technologies can analyse vast amounts of data, uncovering patterns and anomalies that would be nearly impossible for humans to detect. For instance, AI can identify claims that significantly deviate from the norm, allowing investigators to prioritise the most suspicious activity. This increases efficiency and improves the accuracy of fraud detection.

The Growing Importance of Cyber Security Expertise

With the increasing prevalence of cyber-enabled fraud, cyber security expertise is essential for insurance fraud investigators. Understanding how these digital crimes are perpetrated and the digital trails they leave is crucial. This involves knowledge of digital forensics, data recovery, and network security.

Regulatory Changes and Their Impact

The regulatory environment regarding data privacy and investigation practices is continuously evolving. Investigators must stay up-to-date on new laws and regulations, such as GDPR, ensuring all investigations are conducted legally and ethically. This requires ongoing professional development and adherence to best practices.

New Skills For a Changing Landscape

To remain effective, insurance fraud investigators must embrace new skills. Data analysis, cyber security, and an understanding of emerging technologies like telematics and cryptocurrency are increasingly important. Strong communication and analytical thinking skills remain fundamental.

Emerging Career Opportunities

New fraud areas, such as telematics fraud and cryptocurrency-related insurance scams, are creating new career opportunities. Investigators with expertise in these areas will be highly sought after. Adapting to a digital-first investigation approach is also vital, as remote work and digital evidence become more common. This includes experience with virtual interviews, online evidence gathering, and secure data sharing platforms.

The future of insurance fraud investigation presents both challenges and opportunities. By adopting new technologies, developing key skills, and keeping abreast of regulatory changes, investigators can thrive in this dynamic field. For specialised assistance navigating insurance fraud investigation, consider partnering with a reputable firm like Sentry Private Investigators Ltd. They offer a broad spectrum of investigative services customised for individuals and businesses across the UK. Contact them to learn more about how they can help protect you from fraud.

Comments